We’ve been hearing about fuel shortages around the world for more than a year now. It’s starting to look like this just might be the new standard.

But while lack of heat for cooking and heating can lead to some uncomfortable winter nights, the newest iteration of this fuel crisis will have you paying more for everything.

One single type of fuel is the backbone of the world’s transportation system. Ground shipping could screech to a halt if the situation doesn't change soon.

I’m talking about diesel, the magic fossil fuel that powers nearly every truck on the planet.

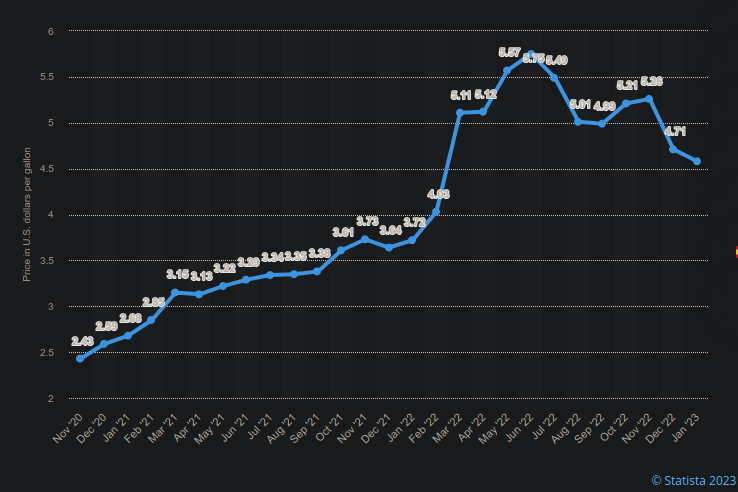

Retail prices in the U.S. recently shot up to an absurd $5.75 per gallon before subsiding to $4.58 one month ago. It’s one of the many reasons why your groceries have gotten so expensive.

But if you think the U.S. is in a tricky situation, you haven't seen anything yet. Our analysts have traveled the world over, dedicated to finding the best and most profitable investments in the global energy markets. All you have to do to join our Energy and Capital investment community is sign up for the daily newsletter below.The Best Free Investment You’ll Ever Make

Though the U.S. is still the world’s biggest oil producer, its reserves have been slowly dwindling compared with years past. Prices have skyrocketed recently, and many drivers are starting to see signs like this at the pump:

It’s a bad sign, but it can always get much worse.

Now, imagine you're in Europe. Russia was your main oil connection, which supplied nearly every refinery on the continent.

Now that the EU price cap is in full effect, Russian oil is headed in the opposite direction. You can suck up all the LNG the U.S. can offer, but what about diesel?

No crude oil means no diesel, gasoline, or any of the millions of petroleum derivatives the average citizen depends on.

This shortage isn't just a U.S. problem. It’s officially gone global.

One Company Is Standing in the Way of an Energy Crisis

It would be rude to bring this problem to your attention without also proposing a solution. I’m anything but a fearmonger.

Although diesel supplies in the U.S. are tight, American producers have the unique ability to scale up as fast as the market does.

The stock pick we have in mind is currently gearing up to refine millions of gallons of diesel in the coming months. That’s not a typo — this relatively small producer really does have that level of bandwidth.

Other larger outfits are bloated to the point of sluggishness. You’d never see any of the big names like Saudi Aramco pivoting this quickly.

This is all happening right now — this isn’t some far off plan to make money by the end of the decade.

This company is moving fast, so that’s exactly what we need to do as investors.

This isn't our team’s first rodeo. Under energy expert Keith Kohl’s careful guidance, we’ve lead readers to impressive returns like:

- 124% on PowerShares DB Crude Oil

- 103% on Petrobank Energy and Resources

- 100% on Northern Oil and Gas

- 215% on American Oil and Gas

- 574% on Brigham Exploration

I could list these winners all day, but I’d rather help you experience wins like these for yourself. If you’re ready to start making the biggest gains of your investment career, keep reading here.

It’s dangerous to dive in alone — take us with you!

To your wealth, Luke Sweeney Luke’s technical know-how combined with an insatiable scientific curiosity has helped uncover some of our most promising leads in the tech sector. He has a knack for breaking down complicated scientific concepts into an easy-to-digest format, while still keeping a sharp focus on the core information. His role at Angel is simple: transform piles of obscure data into profitable investment leads. When following our recommendations, rest assured that a truly exhaustive amount of research goes on behind the scenes..

Contributor, Energy and Capital